The Definitive Guide to Paul B Insurance

Wiki Article

The Basic Principles Of Paul B Insurance

Today, resident, automobile proprietors, businesses as well as organizations have readily available to them a wide variety of insurance items, a lot of which have ended up being a necessity for the functioning of a free-enterprise economic climate. Our society could rarely operate without insurance coverage. There would certainly so much uncertainty, so much direct exposure to unexpected, unexpected perhaps catastrophic loss, that it would be difficult for anybody to prepare with confidence for the future.

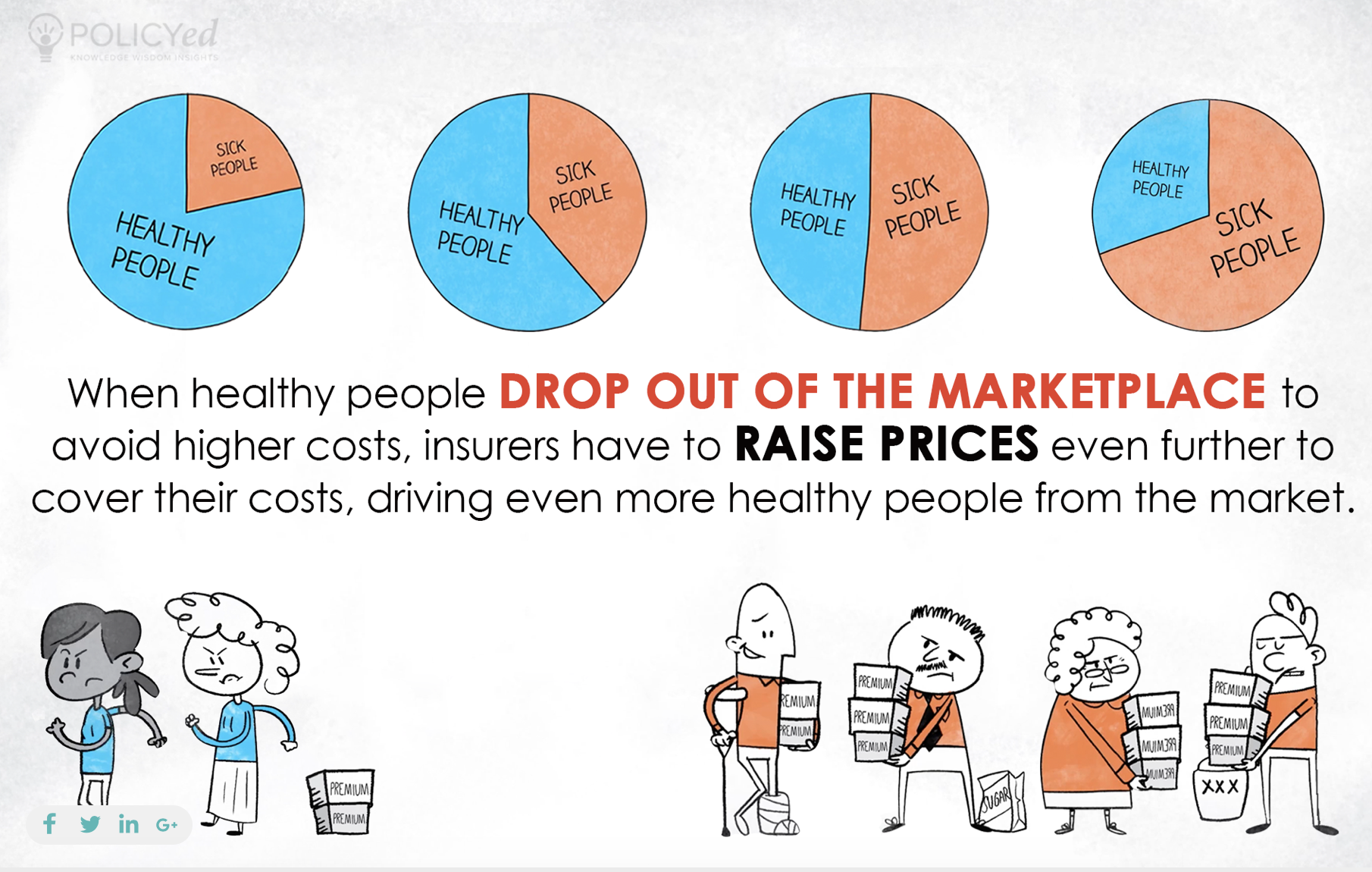

The bigger the variety of costs payers, the more properly insurance companies are able to estimate possible losses thus compute the amount of costs to be accumulated from each. Since loss incidence may change, insurance firms are in a continuous process of accumulating loss "experience" as a basis for routine testimonials of costs needs.

In this respect, insurance companies perform a capital development feature comparable to that of financial institutions. Thus, service ventures acquire a dual advantage from insurancethey are enabled to operate by transferring potentially debilitating threat, and also they also might get funding funds from insurance companies through the sale of stocks and also bonds, for example, in which insurance companies invest funds.

For more on the insurance market's contributions to culture and the economic situation see A Firm Structure: Just How Insurance Policy Supports the Economy.

Paul B Insurance for Dummies

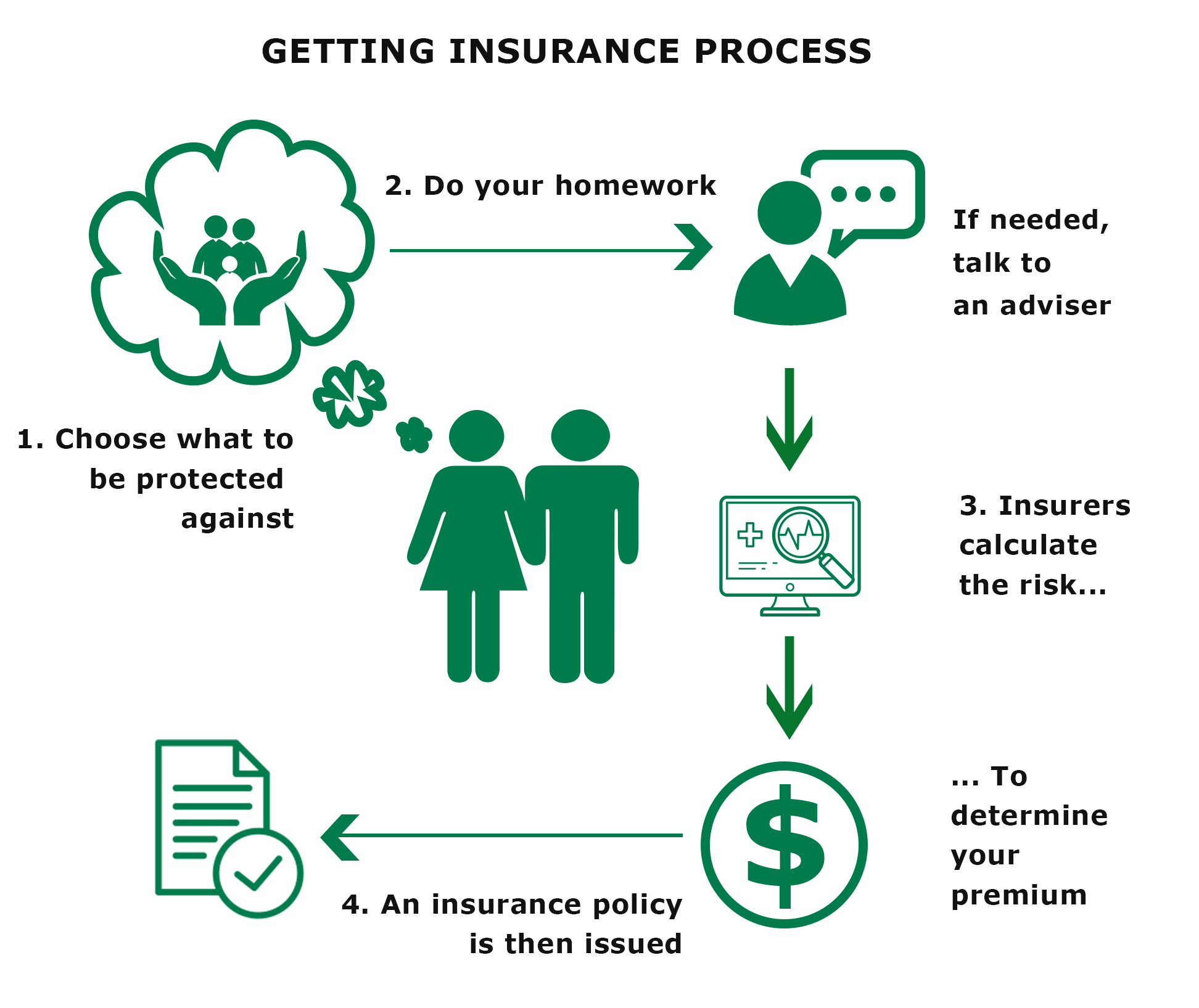

Being aware of what's offered and also exactly how it functions can have a significant influence on the cost you will certainly pay to be covered. Armed with this knowledge, you'll be able to choose the ideal plans that will certainly secure your way of living, possessions, and also residential property.

When you have something to shed, as well as you can not manage to spend for a loss yourself, you pay for insurance coverage. By paying money each month for it, you obtain the tranquility of mind that if something goes wrong, the insurance provider will certainly spend for things you require to make life like it was prior to your loss.

:max_bytes(150000):strip_icc()/what-main-business-model-insurance-companies.asp-FINAL-092abcf238d348c4975e1021489191e6.png)

The insurance company has lots of clients. When a loss takes place, they may obtain insurance coverage money to pay for the loss.

Some insurance coverage is extra, while other insurance, like car, might have minimal needs established out by regulation. Some insurance is not required by legislation. Lenders, financial institutions, and home loan firms will certainly need it if you have borrowed money from them to purchase worth a great deal of cash, such as a house or a cars and truck.

How Paul B Insurance can Save You Time, Stress, and Money.

click for moreYou will certainly require automobile insurance coverage if you have a vehicle loan and Recommended Reading also house insurance if you have a house funding. It is often required to get approved for a car loan for big purchases like residences. Lenders intend to see to it that you are covered against risks that may cause the worth of the vehicle or home to decrease if you were to suffer a loss before you have actually paid it off.

Lender insurance is more costly than the plan you would get on your very own. Some companies may have discounts tailored at bringing in certain types of customers.

Various other insurers may develop programs that provide larger price cuts to senior citizens or participants of the armed force. There is no way to recognize without searching, contrasting plans, and getting quotes. There are three major reasons that you should purchase it: It is needed by law, such as obligation insurance coverage for your automobile.

A financial loss could be beyond what you could afford to pay or recover from conveniently. If you have expensive computer equipment in your house, you will desire to acquire occupants insurance. When the majority of people assume concerning individual insurance policy, they are most likely thinking of among these five major kinds, to name a few: Residential, such as home, apartment or co-op, or occupants insurance policy.

official site

Paul B Insurance - The Facts

, which can fall into any of these teams. It covers you from being filed a claim against if one more individual has a loss that is your fault.

Insurance policy needs licensing and is separated into teams. This means that before a person is legitimately allowed to offer it or provide you with advice, they have to be certified by the state to offer and also give suggestions on the type you are getting. For example, your house insurance coverage broker or representative may tell you that they don't supply life or impairment insurance policy.

If you're able to purchase more than one kind of policy from the exact same individual, you might be able to "pack" your insurance coverage and also get a price cut for doing so. This includes your major home along with any type of other frameworks in the space. You can discover standard health and wellness advantages along with other health and wellness policies like oral or long-term treatment.

The Best Guide To Paul B Insurance

Most individuals do not check out the fine print in their policy. That is why some people end up perplexed as well as upset when they have an insurance claim that doesn't seem to be going their means. These are some vital expressions that you will locate in the little print of your policy.

Some individuals choose a high deductible as a way to save cash. It is crucial to ask concerning the exclusions on any kind of policy you acquire so that the little print doesn't shock you in a case.

If you get a really reduced price on a quote, you need to ask what type of policy you have or what the limitations of it are. Policies all have particular sections that note limitations of quantities payable.

You can often ask for the type of plan that will certainly use you greater limits if the limits revealed in the plan issue you. Some kinds of insurance policy have waiting durations before you will certainly be covered.

Report this wiki page